Student loan debtors got a one-two punch of bad news to bookend the month of June.

At the start of the month, debt ceiling negotiations nixed further student loan payment moratoriums. Come September, payments resume come hell or high water.

Then, at the end of June, the Supreme Court ruled that President Biden’s proposed student loan forgiveness program exceeded the powers of his office.

Many Americans’ budgets are sure to strain in the coming months and … well, for however long it takes to pay off their loans.

Though, debtors may not be the ones with the most to lose.

Certain companies are positioned to take a hit as student loan payments tighten the pocketbooks of over 43 million Americans. An average of $393 each month, per borrower, will essentially be sucked out of the economy and into debt servicing. (That’s over $20 billion per year!)

And consumer discretionary stocks — the companies that make nonessential items — are caught in the crosshairs.

Thinking on this, I scanned several stocks in the Consumer Discretionary Select Sector SPDR ETF (NYSE: XLY) to see which ones rate poorly on my six-factor model, and thus may be under pressure if we see a dramatic contraction in discretionary spending.

If the Supreme Court Justices have investment accounts — fun fact, they’re exempt from the stock-trading rules Congress must follow — they’re probably selling these names as they tighten the screws on disposable income…

The King of Discretionary Spending

Amazon.com Inc. (Nasdaq: AMZN) may represent the ultimate discretionary spending company. And with its behemoth, $1.3-plus trillion market cap, it makes up 23% of XLY.

Not only is AMZN a virtually infinite marketplace for all manner of nonessential goods, its pricey Prime membership is the gateway to getting all of those goods quickly … and accessing other nonessential services such as video and music streaming.

Even Amazon’s grocery business, Whole Foods, could take a hit as consumers look for cheaper essential food options.

These purchases could be some of the first that income-restricted customers look to cut as they make room for student loan servicing.

Granted, much of Amazon’s revenue comes from its cloud computing service AWS, which is contained from the discretionary side of things. Still, slower retail sales will eat into its future potential.

What does my Green Zone Power Ratings system say about Amazon? Let’s take a look…

(Click here to view larger image.)

Amazon rates a “Bearish” 31 out of 100, getting especially poor marks on the Value factor — with most of its valuation metrics extremely overextended.

As we see it, the stock is priced for perfection. And investors who’ve been chasing the Big Tech stocks during the recent rally may be getting over their skis.

Amazon might be the biggest stock on my radar that’s set to suffer from the resumption of student loan repayments, but it’s far from the only one…

Millions Fewer “Coffees”

Sticking on the theme of discretionary-spending companies, we have to look at Starbucks Corp. (Nasdaq: SBUX).

The company infamously sells coffee and … let’s say “coffee-adjacent” drinks at a cost multiples higher than what it would be if you made it at home.

Hypothetically, if just half of all student loan debtors stopped buying their $6 extra-grande orange mocha chocka frappa … thing from Starbucks three times a week, that’s a $156 million revenue hit for Starbucks every single month.

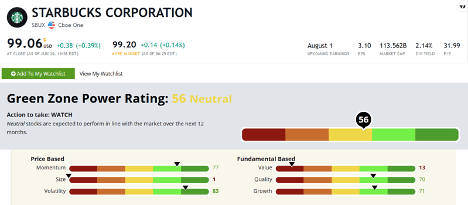

It’s a big chunk of change. And given SBUX’s already poor Green Zone Power Rating, further weakness in revenue could cause investors to flee the stock…

(Click here to view larger image.)

Starbucks stock rates a “Neutral” 56 on the Green Zone Power Ratings system, taking the biggest penalty for Size and Value — just as with Amazon.

This isn’t an awful rating, but we can’t expect market-beating returns out of it, either. This tells me that Starbucks should just match the market’s performance over the next 12 months — up or down.

So there isn’t much benefit to buying Starbucks instead of the S&P 500 … and thus, puts you in needlessly higher levels of risk for that return. By that measure, SBUX is one to avoid simply for being an inefficient place to keep your money.

Though, when it comes to the consumer discretionary sector, you could do worse…

My Old Punching Bag

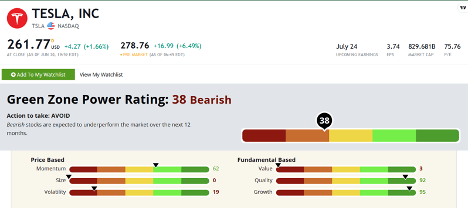

With such a high weighing in XLY (19%) … I couldn’t help but take a look at my old favorite punching bag, Tesla Inc. (Nasdaq: TSLA).

Tesla, as a luxury electric vehicle maker, is a perfect fit for the consumer discretionary category. It does best when the economy is good and people have money to spend on new toys.

It’s been on a great rally in 2023, but does that make it a great stock for the next 12 months? I don’t think so…

(Click here to view larger image.)

TSLA is another discretionary stock to avoid as student loan payments kick in again. It rates a “Bearish” 38 out of 100, being a highly volatile, poor value and mega-cap stock.

I’ve spilled a lot of ink on these pages and elsewhere on why I think TSLA is grossly overvalued and at risk of repricing meaningfully lower.

Its rally so far in 2023 hasn’t changed much in my view. TSLA’s volatility score alone basically ensures it will fall faster and further than the broad market if we get another downturn.

Speaking of another downturn…

The morning I wrote this, 91% of the stocks in the Nasdaq 100 were down along with the index itself.

That’s not a good sign for 2023’s wonder rally, which might just be stalling before our eyes.

That’s why I recently came forward and published a Blacklist of nearly 2,000 stocks that are likely to be money-losers in the months to come.

Alongside that, I recommended 11 stocks that rate a 95 or above which are set to outperform the market in the next year. Each one is a high-quality, practically unheard-of gem that spans a wide variety of market sectors.

To get your hands on the tickers in this high-quality, highly diversified portfolio, get all the details here.

To good profits,

Adam O’Dell

Adam O’Dell

Chief Investment Strategist, Money & Markets

I mentioned yesterday that I’m in the Spanish Basque Country with my family. It’s lovely, and I recommend you put the area on your travel bucket list.

But as I spend time here, I’m consistently noticing something: The service is terrible.

No offense to the waiters, Uber drivers, hotel staff or any number of other service workers I’ve interacted with. They’ve all been exceptionally friendly and tolerant of my unintelligible and thickly accented Peruvian- and Mexican-influenced Spanish. They work hard and put up with a lot.

The problem is that there simply aren’t enough of them.

After decades of having one of the lowest birth rates in the world, Spain has a dearth of young people that generally handle service jobs. The reason it took half an hour for my beer to arrive is that the waiter that should have been grabbing it was never born.

And it’s not just Spain, of course. This is a problem across the developed world, and it’s at its most extreme in the developed parts of East Asia. In South Korea, there were more than 40,000 child care centers in 2017. In less than six years, that figure has dropped to around 30,900, a reduction of close to a quarter.

There are not enough children to warrant keeping the doors open.

Of course, the other side of that coin is that the population is aging. Over the same period, the number of elderly facilities has grown from around 76,000 to nearly 90,000.

There are multiple overlapping problems here:

- How do you support a national pension or health insurance program when there are no young people to contribute, and proportionately, more of the older generations using the benefits?

- Where does your tax base come from?

- How do you sell your house when there are no young families coming down the pipeline to buy it?

- And perhaps most importantly of all, where do you find workers?

The short answer is: “You don’t.”

Yes, immigration can help plug gaps, but that is also a zero-sum game. The new immigrant might plug a gap in their host country, but then that is one less worker in their home country, and the dearth of young workers is a global issue.

You can also change your business model. It might sound absurd to go to a bar and pour your own beer from the tap, but something like that isn’t too far-fetched. Not that long ago, bagging your own groceries or pumping your own gas would have sounded absurd.

The only real solution is to boost productivity or to get more output from each worker. And artificial intelligence is a big part of that solution.

I don’t know that AI would have helped much in getting my beer to my table in less than 30 minutes. But it is already enabling companies to leverage their workforce and replace (or reduce) time-consuming and repetitive tasks.

And it’s only just starting.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

Leave a Reply